The balance-to-limit ratio, also known as the credit utilization ratio, is a measure used by credit scoring models to assess how much of your available credit you are using. It is calculated by dividing your total credit card balances by your total credit card limits. Use our calculator to seamlessly find out your Balance To Limit Rato without any kind of problems.

In this guide, we will explain everything that you need to know about Balance to Limit. Let’s start!

How To Calculate Balance To Limit Ratio?

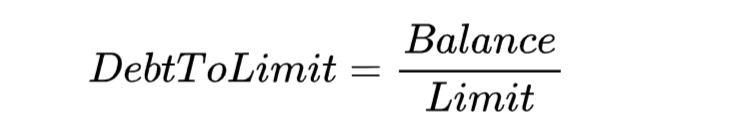

Calculating the balance-to-limit ratio is very easy, you just need to follow the instructions. Here is the formula:

The Terminology:

- Balance: The total credit card balance you have

- Limit: The total credit card limit you have

This ratio is very essential and is used in calculating the FICO scores. What is a good balance-to-limit ratio though? Normally, a ratio under 30% is considered good and that is what you should aim for.

Field Help

Input Fields

Title: A title for these calculator results that will help you identify it if you have printed out several versions of the calculator.

Credit Card Issuers: The credit card issuer – Visa/MasterCard might be enough, or the name of the issuing bank. This field is just to help you identify which card this is.

Balances: Your current outstanding balance on this credit card.

Limits: Your credit limit for this credit card.

Output Fields

Ratios: ‘Balance’ / ‘Limit’ gives the percentage or ratio of how much of the limit is used for this card.

Totals: Add the ‘Balances’ and ‘Limits’ down the columns. Calculate ‘Total Balance’ / ‘Total Limit’ to give the total percentage or ratio of how much of the total limit of all your credit cards is used.

What Is The Significance Of The Balance-To-Limit Ratio?

The Balance-To-Limit Ratio or the Credit Utilization score is a very important tool to know about your own financial situation or of a company’s. Here are the reasons why it is so important:

- Impact on Credit Score: It is a major factor in determining your credit score. A lower ratio is typically better and can positively impact your score, while a higher ratio can negatively affect it.

- Financial Health Indicator: It can be an indicator of your financial health and how well you manage your credit. A lower ratio suggests responsible credit usage and may be viewed more favorably by lenders.

- Lending Decisions: Lenders often consider your balance-to-limit ratio when making decisions about extending credit. A high ratio may indicate a higher-risk borrower, while a low ratio may indicate a lower risk.

- Interest Rates: Your ratio can also affect the interest rates you are offered. A lower ratio may lead to lower interest rates, while a higher ratio could result in higher rates or less favorable terms.

- Credit Card Limits: Maintaining a low ratio may also encourage credit card issuers to increase your credit limits, which can further improve your ratio and potentially your credit score.

FAQs

Question: What Proportion Of The Balance-To-Limit Ratio Is Too High?

A score above 30% would be considered too high.

Question: Can We Use 90% Of Credit Limit?

Yes, in you can use that limit but it will only worsen your credit score. It is advised to keep the score below 30%.

Question: What Is The 30 Rule For Credit Cards?

This rule indicates only using 30% of your total credit card limit.

credit card application

How do I add Lines to the Balance to Limit Ration Calculator