What is Amortization Calculator?

An amortization calculator is a financial tool used to determine the payment schedule and breakdown of principal and interest for a loan, typically a mortgage. It allows borrowers to understand how their payments are applied over time and how much of each payment goes towards reducing the loan balance versus paying interest.

Benefits of Using An Amortization Calculator:

- Payment Planning: It helps borrowers plan their budget by providing a clear picture of their monthly payments throughout the loan term.

- Understanding Loan Costs: Borrowers can see how much of each payment goes towards interest and how much goes towards reducing the principal balance, helping them understand the true cost of borrowing.

- Comparison of Loan Options: By inputting different loan terms and interest rates, borrowers can compare different loan options to find the most suitable one for their financial situation.

- Early Payoff Strategy: Borrowers can use the calculator to explore how making additional payments or paying more frequently can shorten the loan term and reduce the total interest paid.

- Financial Literacy: Using an amortization calculator can improve financial literacy by helping borrowers understand complex loan terms and concepts such as interest accrual and amortization schedules.

Overall, an amortization calculator is a valuable tool for borrowers to make informed decisions about their loans, manage their finances effectively, and work towards their financial goals.

Learn How to Use Our Calculator with These Step-by-Step Instructions

Understanding your mortgage is crucial, and our Amortization Calculator is here to help you navigate the details. Let’s walk through each step and explore the valuable insights it provides.

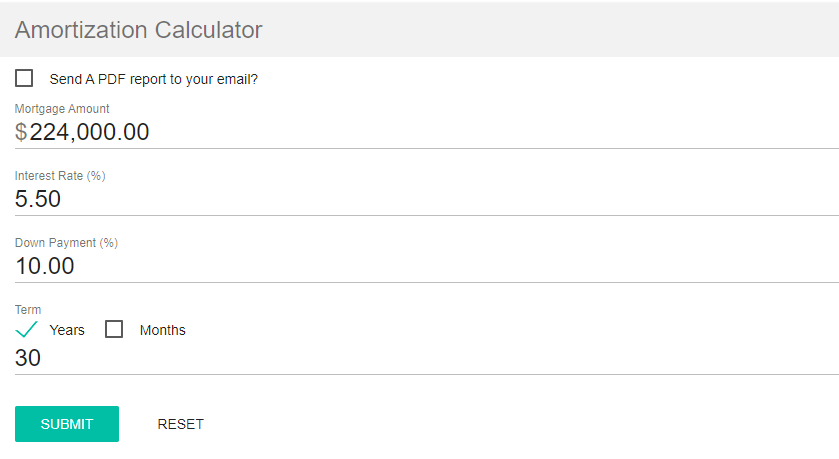

Step 1: Enter Your Loan Details

- Mortgage Amount: This is the total sum you plan to borrow from a lender to finance your home purchase.

- Interest Rate (%): This is the annual percentage rate (APR) you’ll be charged on the loan. This directly affects your monthly payments and total loan cost.

- Down Payment (%): This represents the upfront portion of the purchase price you’ll pay in cash. A higher down payment reduces the amount you need to borrow and can lead to lower monthly payments and potentially better loan terms.

Step 2: Select Your Loan Term

Indicate the duration of your mortgage, typically expressed in years (e.g., 15 years or 30 years). A longer-term translates to lower monthly payments but ultimately means you’ll pay more interest over the entire loan period.

Step 3: Click “Submit”

Once you’ve entered all the information, click the “Submit” button. The calculator will analyze your input and provide a comprehensive breakdown of your mortgage.

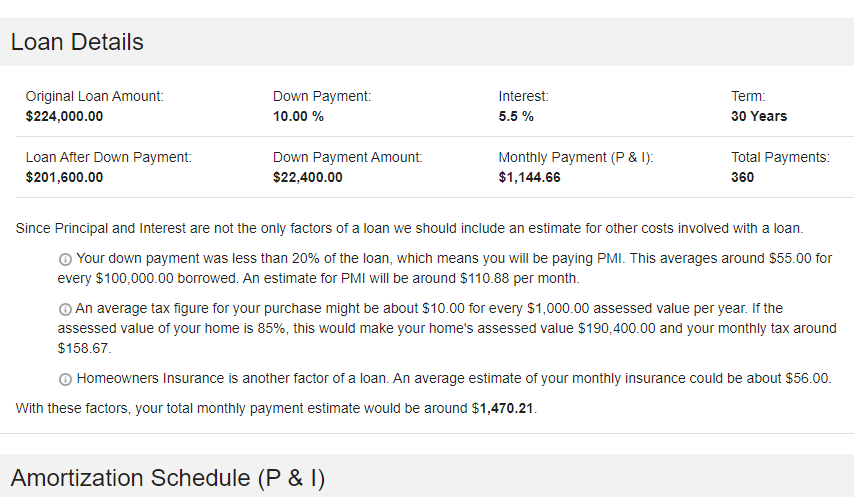

Understanding Your Loan Details:

- Loan Details: This section will display the original loan amount, down payment amount, interest rate, and standard loan term (often 30 years).

- Loan After Down Payment: Here, you’ll see the remaining loan amount after subtracting your down payment. This is the actual sum you’ll be borrowing.

- Down Payment Amount: This confirms the amount you’re contributing upfront.

- Monthly Payment (P & I): This crucial figure represents your estimated monthly payment, encompassing both principal (the borrowed amount) and interest.

Beyond Principal and Interest:

Your total monthly expenses extend beyond the basic P&I payment. Here’s what the calculator might reveal:

- Private Mortgage Insurance (PMI): If your down payment is less than a certain percentage (often 20%), you might need to pay PMI. The calculator can estimate the monthly PMI cost based on your loan amount.

- Property Taxes: This section provides an estimate for yearly property taxes based on an average tax rate and your home’s assessed value (a percentage of the market value). The calculator might then translate this into a monthly tax expense.

- Homeowners Insurance: An estimated monthly cost for homeowners insurance is included, offering a more comprehensive picture of your total housing expenses.

Total Monthly Payment Estimate:

The calculator will combine your P&I payment with estimated costs for PMI, property taxes, and homeowners insurance to provide a more realistic picture of your total monthly housing expense.

Amortization Schedule (P & I):

This valuable table details how each monthly payment contributes to your loan over time. It typically shows the breakdown of principal and interest for each payment period, allowing you to visualize how your loan progresses toward full repayment.

Mortgages: Financing Your Dream Home

A mortgage is a loan specifically designed to finance the purchase of real estate, typically a house or condominium. It’s essentially a long-term agreement between you (the borrower) and a lender (usually a bank or credit union).

Here’s a breakdown of the key components of a mortgage:

- Loan Amount: This is the total sum you borrow from the lender to cover the purchase price of your home.

- Down Payment: This represents the upfront portion of the purchase price you pay in cash. A higher down payment reduces the loan amount you need to borrow and can lead to several benefits, such as lower monthly payments and potentially better loan terms.

- Interest Rate: This is the annual percentage rate (APR) you’ll be charged on the loan. The interest rate significantly impacts your monthly payments and the overall cost of your loan.

- Loan Term: This determines the duration of your mortgage, typically expressed in years (e.g., 15 or 30 years). A longer-term translates to lower monthly payments but ultimately means you’ll pay more interest over the entire loan period.

The Mortgage Process

To secure a mortgage, you’ll typically need to go through a pre-approval process with a lender. This involves submitting financial documents to assess your creditworthiness and borrowing capacity. Once pre-approved, you can search for your dream home and make an offer with confidence, knowing the maximum loan amount you qualify for. Upon finalizing the purchase agreement, you’ll work with the lender to finalize the mortgage details and close the loan.

Amortization: The Gradual Payoff Journey

Amortization refers to the gradual process of paying off a loan over time. It encompasses both the principal (the actual amount you borrowed) and the interest accrued on the loan. With each monthly mortgage payment, a portion goes towards reducing the loan principal, and the remaining amount covers the interest.

Understanding an Amortization Schedule:

An amortization schedule, often generated by a mortgage lender or through an amortization calculator, is a detailed table that breaks down each monthly payment over the loan term. It typically shows:

- Payment Amount: The total monthly payment you make towards your mortgage.

- Principal Portion: The amount of your payment that goes towards reducing the remaining loan balance.

- Interest Portion: The amount of your payment that covers the interest accrued on the outstanding loan balance.

Benefits of Amortization:

- Predictability: Knowing your monthly payment amount allows for predictable budgeting and financial planning.

- Debt Reduction: With each payment, you steadily reduce your loan principal, moving closer to owning your home outright.

- Sense of Progress: The amortization schedule provides a visual representation of your progress towards full loan repayment, fostering motivation and a sense of accomplishment.

Important Details to Consider:

- Early Payments: Making additional payments towards your principal can significantly accelerate the payoff process and save you money on interest.

- Loan Term: A shorter loan term generally translates to higher monthly payments but ultimately results in less total interest paid. Conversely, a longer loan term offers lower monthly payments but comes with a higher overall interest cost.

- Interest Rates: Securing a lower interest rate translates to significant savings over the life of your loan. Consider comparing rates from different lenders to find the best deal.

Working Together: Mortgages and Amortization

Mortgages provide the financial means to purchase a home, while amortization outlines the gradual repayment process. Understanding both concepts empowers you to make informed decisions about your loan term, interest rate, and potential prepayment strategies. By leveraging this knowledge, you can navigate your homeownership journey with confidence and clarity.

FAQS

1. What is the difference between amortization and depreciation?

Amortization and depreciation are both methods of allocating the cost of an asset over its useful life, but they apply to different types of assets. Amortization typically refers to the gradual repayment of a loan or debt, while depreciation is the allocation of the cost of tangible assets, such as machinery or equipment, over their useful life.

2. Can I pay off my mortgage early?

Yes, most mortgages allow borrowers to pay off their loans before the end of the term without penalty. This can save on interest costs and allow homeowners to own their homes outright sooner. However, some mortgages may have prepayment penalties or restrictions, so it’s essential to review the terms of the loan agreement.

3. What is Private Mortgage Insurance (PMI), and do I need it?

PMI is insurance that lenders typically require borrowers to purchase if their down payment is less than 20% of the home’s purchase price. PMI protects the lender in case the borrower defaults on the loan. Once the borrower’s equity in the home reaches 20%, PMI can usually be canceled.

4. What factors affect my mortgage interest rate?

Several factors can influence mortgage interest rates, including the borrower’s credit score, loan-to-value ratio, loan term, down payment amount, and prevailing market conditions. Generally, borrowers with higher credit scores, lower loan-to-value ratios, and larger down payments qualify for lower interest rates.

5. What is an escrow account, and how does it work?

An escrow account is a separate account held by the lender to manage payments for property taxes and homeowners insurance on behalf of the borrower. Each month, a portion of the borrower’s mortgage payment is deposited into the escrow account. When property taxes or insurance premiums are due, the lender pays them from the escrow account on behalf of the borrower.

Related Calculator