Having a well-designed calculator can help accurately generate monthly payments for an adjustable-rate mortgage (A.R.M.) loan. Typically an ARM will have a lower interest rate as compared to fixed-rate mortgages. This is attractive for planning to own a home for a short period, expecting future income increases, or when fixed-rate mortgage interest rates are high.

How It Works

The interest rate on an ARM is calculated by adding a margin to an index, and as the index fluctuates, the interest rate adjusts accordingly. This calculator helps you figure out what might happen with a special type of loan called an adjustable-rate mortgage. You put in details like the price of the house, how much money you’re putting down, and how long you’ll pay back the loan. It then shows you things like your starting monthly payment, the most you might have to pay each month, and how much interest you’ll pay over time. You can also add extra costs to the loan and see how paying a bit more each month could help you finish paying off the loan sooner. Plus, it can give you a schedule showing how your payments will change over time.

Field Help

Input Fields

Title: A title for these calculator results that will help you identify it if you have printed out several versions of the calculator.

Lender: The name of your potential lender. This field is not required but may help if you have printed out several loan scenarios.

Sale Price: The sale price for your property. (NOT the amount of money you plan to borrow.)

Down Payment: The amount of money you plan to put as a down payment on your property.

Initial Interest Rate: The initial interest rate for your adjustable rate mortgage.

Length of Initial Fixed Rate: The length of time the ‘Initial Interest Rate’ is guaranteed or fixed. The ‘Length of Initial Fixed Rate’ is probably several years and is usually longer than the ‘Minimum Length Between Steps’. Also, choose whether the ‘Length of Initial Fixed Rate’ is years or months.

Maximum Interest Rate Step: The maximum percent of your interest rate can go up each time it is adjusted.

Minimum Length Between Steps: Each interest rate adjustment will hold the new rate for at least this long. Also, choose whether the ‘Minimum Length Between Steps’ is years or months.

Maximum Interest Rate: Your interest rate cannot go higher than ‘Maximum Interest Rate’.

Length of Loan: How long you will pay on this loan? Also, choose whether ‘Length of Loan’ is years or months.

Additional Principal: The additional amount you will pay each month (over the required monthly amount) to pay down the principal on your loan. While paying additional principal each month on a traditional mortgage has a significant effect on the payoff time, it does not have that same effect on the payoff time of an adjustable-rate mortgage. That’s because each time the interest is adjusted the payment changes and is calculated on the balance at the time of adjustment spread over the remaining payoff time. Even though additional principal doesn’t pay an adjustable rate mortgage off a lot quicker, it does keep the payments more even between the high and low-interest rate as it is adjusted.

Points: The number of points (or percentage of the loan amount) you’ll be paying to close this loan. Check ‘Roll into Loan’ if the cost of the loan points is being financed and included in the ‘Loan Amount’.

Other Closing Costs: Any other costs you’ll be paying during the closing of your loan. These might be costs like the appraisal, property taxes, property insurance, title insurance, realtor fees, etc. Check ‘Roll into Loan’ if your closing costs (not to include loan points) are being financed and included in the ‘Loan Amount’.

Output Fields

Initial Payment: ‘Principal’ + ‘Interest’ + ‘Additional Principal’ (where applicable) to be paid each month. Actual payment could include escrow for insurance and property taxes plus private mortgage insurance (PMI).

Maximum Payment: ‘Principal’ + ‘Interest’ + ‘Additional Principal’ (where applicable) to be paid each month. Actual payment could include escrow for insurance and property taxes plus private mortgage insurance (PMI).

Average Payment: ‘Principal’ + ‘Interest’ + ‘Additional Principal’ (where applicable) to be paid each month. Actual payment could include escrow for insurance and property taxes plus private mortgage insurance (PMI).

Loan Amount: ‘Sale Price’ – ‘Down Payment’ + ‘Points’ (if rolled into loan) + ‘Other Closing Costs’ (if rolled into loan).

Maximum Total Interest: Total amount of interest you will pay over ‘Length of Loan’.

Maximum Total Paid: Total amount of principal + interest you will pay over ‘Length of Loan’.

Payoff Time: Amount of time until the loan is paid off.

Number of Payments: The number of payments you will make to pay off the loan.

Average Annual Cost: The amount of money you will pay each year for this loan.

Points Amount: The points percentage applied to the amount you borrow gives the dollar amount the loan points will cost.

Maximum Total Property Cost: Total cost of this property when you include the ‘Sale Price’, ‘Points Amount’, ‘Other Closing Costs’, and the ‘Total Interest’ to be paid on the mortgage.

Understanding an Adjustable Rate Mortgage (ARM)

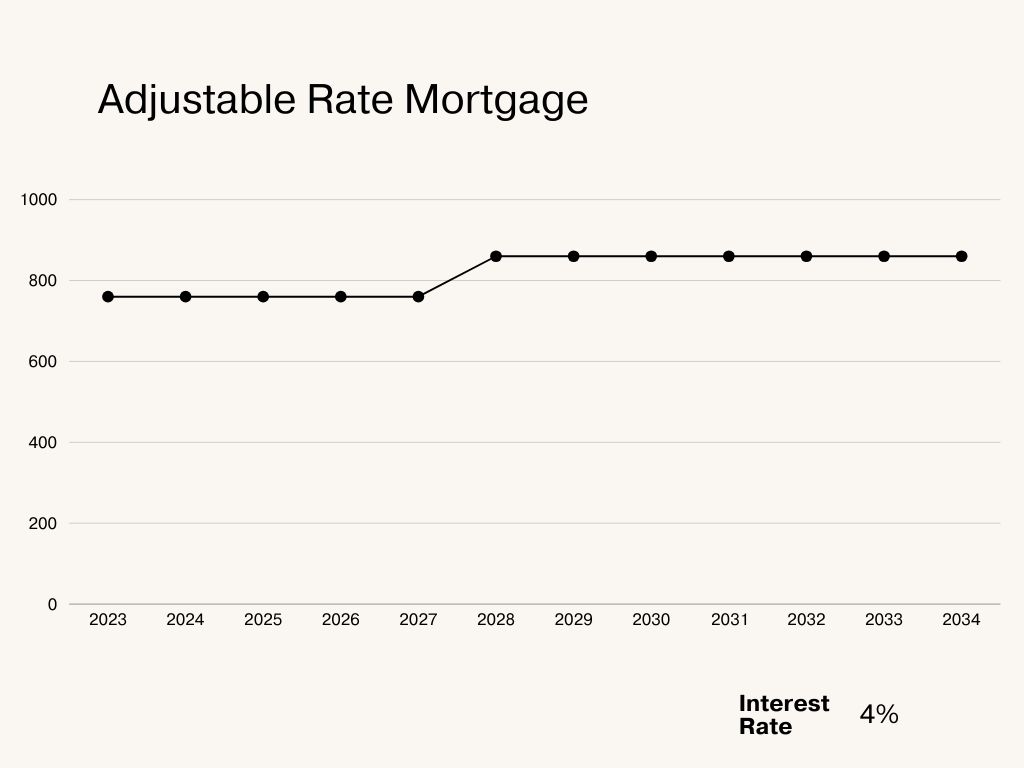

Let’s say you’re buying a house for $200,000. You decide to make a down payment of $40,000 and take out a mortgage for the remaining $160,000. You opt for an adjustable-rate mortgage (ARM) with an initial fixed interest rate of 3% for the first five years. After that, the interest rate can change every year based on the market.

Here’s how it might work:

1. Initial Fixed Rate Period (First Five Years):

During this time, your monthly payments are predictable because the interest rate is fixed at 3%. Let’s say your monthly payment is $760 (excluding taxes and insurance).

2. Adjustable Rate Period (After Five Years):

After the initial fixed period, the interest rate can change annually based on market conditions. If the interest rate increases to 4%:

Your monthly payment could rise to around $860, increasing your monthly payment by $100.

3. Subsequent Rate Adjustments:

Each year, the interest rate could continue to fluctuate, affecting your monthly payment accordingly.

4. Impact of Maximum Rate and Caps:

Most ARMs have caps to limit how much the interest rate can increase over the life of the loan. For example, if your ARM has a maximum interest rate cap of 6%, your interest rate cannot exceed that amount, even if market rates rise higher.

5. Possible Savings and Risks:

While ARMs often start with lower initial rates compared to fixed-rate mortgages, they come with the risk of higher payments if interest rates rise in the future. However, if rates remain stable or decrease, you might save money compared to a fixed-rate mortgage.